Tendermint’s Proof of Stake

A Blockchain is a database used to implement tamper-resistant distributed ledgers where transactions from users are packaged into blocks and a network of computer nodes, a.k.a consensus nodes, follows a consensus protocol to agree on their validity before applying definitive changes to their respective ledgers.

Blockchain systems can be classified according to their specific resistance mechanism to Sybil attacks, where a single entity creates multiple fake nodes in an attempt to compromise the network. To prevent Sybil attacks, mechanisms typically require nodes to consume some type of resource in order to participate in the consensus process. This resource consumption creates a "resource sink" that makes it difficult for malicious actors to create many fake nodes and serves as a deterrent against attacks on the network. In addition, to incentivize network security, blockchain systems often use a reward scheme that compensates the nodes that participate in the consensus process. This reward is typically paid out in the form of the native token of the blockchain, and it is designed to offset the cost of the resource sink. By creating an "honest-rewarding" scheme that rewards consensus nodes for acting honestly, the consensus mechanism creates a Nash equilibrium, where it is in the best interest of nodes to act honestly and contribute to the security of the network.

Proof-of-work (PoW) is a consensus mechanism used by many blockchain systems and first introduced by the popular Bitcoin cryptocurrency. In a PoW system, a single node can add a new block to the blockchain by solving a complex cryptographic puzzle, which requires consuming significant amount of computational power, and therefore energy. While PoW is effective at securing the network and preventing Sybil attacks, it has been criticized for its high energy consumption and for offering only probabilistic finality, as it can potentially allow for the creation of forks.

In a proof-of-stake (PoS) system, nodes must lock some of their tokens as collateral in order to participate in the consensus process and add new blocks to the blockchain. The nodes that are eligible to do so are chosen based on the amount of stake they hold, rather than their computational power. PoS systems, unlike PoW, offer fast finality as forks can only occur at the social layer rather than the consensus layer, making them more suitable for applications that require rapid confirmation of transactions. This important distinction contributes to their increasing popularity. One popular PoS system is Tendermint, which is used as the foundation of the KIRA network.

Tendermint satisfies the following mechanism to reach consensus over a each block :

Consensus nodes must lock capital in the native protocol currency to participate in block creation on the Kira Network. Network participants can delegate assets to consensus nodes to indirectly participate in consensus. An algorithm selects online consensus nodes based on their stake to form a committee, called the consensus node set. This committee approves or rejects blocks proposed by a block proposer. If a block receives approval from a super majority (2/3) of the consensus node set, it is added to the blockchain. If the block is invalid, or the block proposer does not behave correctly or times out, the block is discarded and a new block proposer is chosen. The block proposer role rotates in a weighted round-robin fashion. The more stake delegated to a consensus node, the more times it will be elected as block proposer and receive rewards. The more capital locked and spread among different nodes, the more expensive it becomes for an attacker to compromise the network.

The process of locking tokens as collateral on a blockchain is called staking. This process carries some risks, as the network can partially or fully confiscate the collateral if the consensus node in charge of it is caught violating the protocol. In order to incentivize the economic security and stability of the network, all participants in the staking process receive staking rewards as compensation for the services they provide as consensus nodes and/or the risks they take as delegators. Read the  Jailing & slashing section to know the risk.

Jailing & slashing section to know the risk.

KIRA’s Multi-Bonded Proof of Stake

KIRA Network's Multi-Bonded Proof of Stake (MBPoS) consensus mechanism enables decentralization of the value at stake and does not assume that token holders are rational economic actors. In contrast to plutocratic Proof of Stake models, which only allow for a single native asset to be staked and determine voting power proportionally, KIRA allows network participants to use multiple digital assets as staking collateral. There are no limitations on the types of assets that can be staked, such as NFTs, commodities, RWA, LP tokens, and stablecoins, as long as they are whitelisted through a governance proposal. Additionally, the consensus node set is no longer bound to a fixed number of validators whose eligibility is stake-dependent. Instead, entering and leaving the set is permissioned by governance, and the block proposer rotation follows an equal probability round-robin mechanism.

KIRA also supports liquid staking by automatically issuing staking derivatives whenever network participants stake their tokens. These derivatives represent the locked assets 1:1 and enable network participants to access DeFi applications within and outside the KIRA Network while still securing the network and benefiting from block and fee rewards. For example, staking BTC would issue a staking derivative sBTC to the delegator. While the original BTC remains illiquid and slashable, sBTC can be freely transferred and traded inside or outside of KIRA. If the staked BTC is slashed due to block proposer misbehavior, the sBTC derivative would only be able to claim a portion of the BTC coins it represents.

Roles, Tasks & Responsibilities

KIRA defines four types of network participants: regular users, block proposers, delegators and fishermen, of which the last three can take part in KIRA’s security in ways that bear different responsibilities.

Consensus nodes are active participants in the network that are responsible of storing data, processing transactions, and adding new blocks to the blockchain by running a consensus node. Each node is responsible for creating and managing its unique staking pool where delegators can lock their funds to provide security to the network. In traditional PoS systems, block producers are pre-selected to produce blocks based on the stake backing them however in KIRA, each consensus node have equal chance to propose new blocks as well as equal voting power. Entering and leaving the consensus node set is permissioned by the governance which determines its own rules for onboarding new consensus nodes to prevent sybil attacks. By requiring that consensus nodes are identifiable and active community members the governance can exponentially increase difficulty of forming cartels by large token holders with conflicting and purely profit seeking intentions.

For more information regarding KIRA’s governance mechanisms, please refer to the  Roles & Permissions module.

Roles & Permissions module.

Delegators are any network participants who which to engage in the network security by putting assets as collateral to one or multiple staking pools without necessarily running a consensus node. Note that KIRA doesn’t require block proposers to have a minimum self-bonded stake to pledge their honesty, it is therefore the responsibility of delegators to exercise due diligence and diversification when choosing a block proposer staking pool since the risk of staked assets is directly exposed to the block proposer actions. However, contrary to other PoS blockchains, double-singing is the only behavior that result in slashing in KIRA (downtime is not penalized).

Fishermen

More on this role in a future update

KIRA economics

Staking Rewards

Staking rewards are essential to the network security sustainability as they incentivize network participants in operating nodes and/or putting assets as collateral. KIRA has 2 main types of rewards : block rewards & fee rewards.

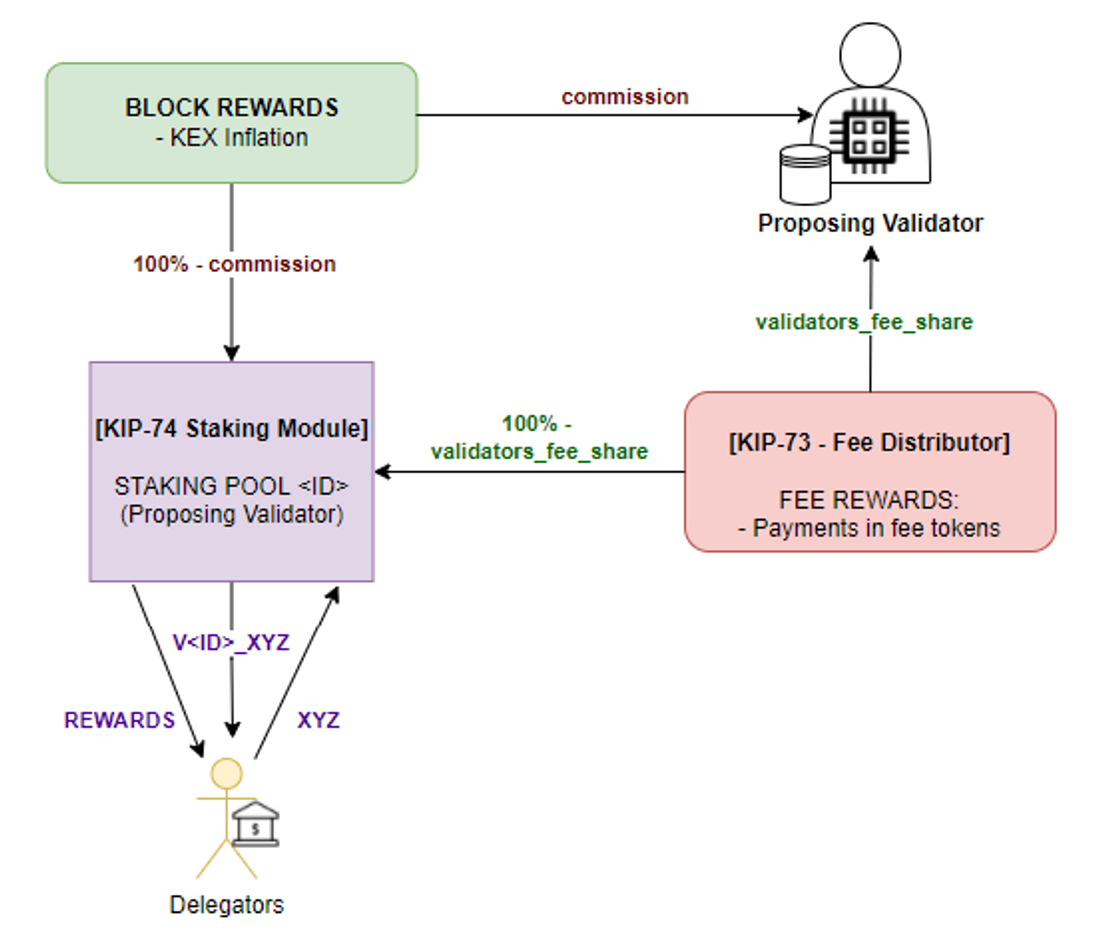

They are distributed in slightly different ways but follows a simple generic pattern: they are awarded per block, the selected block proposer takes a cut before the rest is shared among its respective delegators.

Block rewards are fixed amount of KEX tokens minted in each block — The block proposer takes a cut according to its own staking pool’s commission rate while the remainder is shared between its delegators according to the total value of all the tokens they have delegated among all active staking pools. Hence, block rewards compensate delegators proportionally to the risk they are taking network-wise — this is similar to Cosmos rewards distribution.

Fee rewards are portion of the execution fees paid by users for each transactions — The block proposer takes a cut of those fees according to the validators_fee_share network property, the remainder is shared between its delegators according to their share of this staking pool. Hence, fee rewards only compensate delegators proportionally to the risk they are taking locally — this is similar to Polkadot rewards distribution. While this might seem a bit counter intuitive, this effectively encourages users to equally split their stake among multiple consensus node specifically those with lower staked amount, to maximize their fee rewards eligibility. In fact, if every delegators were to stake with only one block proposer, they would be missing on all fee rewards allocated to other existing staking pools when they produce blocks

For a better understanding regarding network rewards distribution, please refer to the  Fees and staking rewards distribution module.

Fees and staking rewards distribution module.

KEX, KIRA’s native token

The KIRA network uses a shared clock to define the inflation rate of KEX, rather than relying on the traditional block time. This means that the amount of block rewards given out can fluctuate depending on network latency, block proposer timeouts, and other factors. This design choice was made to prevent consensus nodes from attacking the network by speeding up the block speed in order to increase KEX inflation, while simultaneously rejecting incoming transactions. While this approach may seem unfair at first glance, it ensures that over the long term, everyone participating in the network will receive their fair share of rewards on average.

The inflation rate of the native asset KEX is determined by the governance of the network. Inflation is used to attract activity and participation on the network, as well as to provide security through incentivizing stakeholders to hold valuable assets. The Token Rate Registrar module also allows the governance to define the distribution of incentives in order to maintain the relevance and value of KEX. This is an important part of the system's design, as it ensures that the native asset remains an attractive and desirable token for users and stakeholders to hold and use. By incentivizing participation and holding, the network is able to maintain a high level of security and value.

Governance can configure KEX’s inflation rate with the following network properties:

inflation_rate - KEX inflation percentage

Default: 18

Minimum: 0

Maximum: 50

inflation_period - Period of time in seconds over which current KEX supply is inflated by inflation_rate

Default: 31557600 (=1 year)

Minimum: 2629800

Maximum: 31557600

E.g: If the KEX token supply at the time is , inflation rate is set to while the inflation period is then ALL delegators who are staking their coins for the period of should be eligible to cumulatively claim .

KEX economics

Auxiliary rewards

In addition, KIRA has two subsidiary sources of extrinsic rewards which are more circumstantial:

Universal Basic Income (from KEX inflation) — The  Universal Basic Income module allows to create various incentivization schemes for a specific network purposes (e.g. increasing block rewards if the network security subsidy becomes too low), or a specific role (e.g. community managers).

Universal Basic Income module allows to create various incentivization schemes for a specific network purposes (e.g. increasing block rewards if the network security subsidy becomes too low), or a specific role (e.g. community managers).

Stake grants (from KIRA’s treasury) — Winners of the incentivized games will be allocated some amount of staked KEX from the treasury to help them bootstrapping their nodes.

KIRA’s rewards recap